Tax very rarely is a simple matter, whether you are Employed, Unemployed, Self-Employed or A N Other; but the measures set to come into effect from April 2018 and then every subsequent year thereafter are even causing the Chancellor of the Exchequer’s own party members to raise eyebrows, nay – voices.

It is well known that being Self-Employed in the United Kingdom allows for some benefits when taking into account Personal Taxation, specifically – National Insurance Contributions (NICs), which, if you are an Employee, are usually automatically taken through the PAYE process and indeed, both Employers and Employees pay contributions to the Government for ‘National Services’, the State Pension essentially being the most prominent of these.

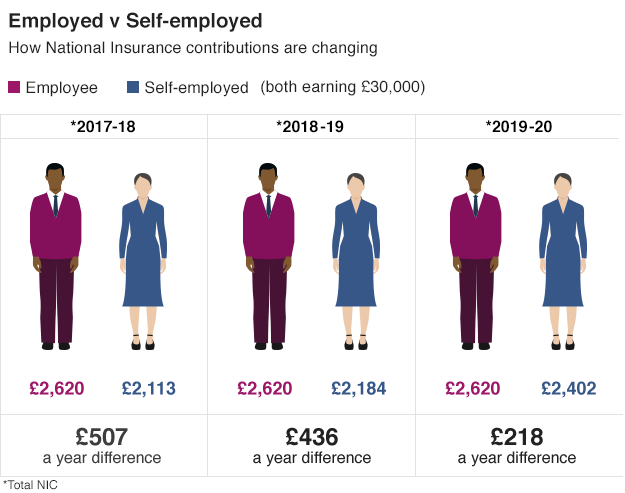

As a Self-Employed professional, these NICs have always been less than what an Employed person would generate and in order to redress this unbalance, the Chancellor, Philip Hammond, has decided to raise the NICs for the Self-Employed, rather than alter, in some other way, the means in which NICs for the employed worker are managed and quite understandably, some quarters are a little perturbed by this.

This graphic (Source: PwC) succinctly displays the existing state of affairs and how the changes are set to affect people..:

This increase in National Insurance Contributions, essentially is a Manifesto Promise-breaker from 2015, before the General Election, when the Conservative Party said they would not raise Tax or National Insurance. However, the Institute for Fiscal Studies has backed Mr Hammond over the NI rise for the Self-Employed saying that with these measures coming into effect, Self-Employed people will still be far better off from taxation benefits than an Employed person, earning the same wage.

It is hard enough setting up your own business and this is not necessarily limited to the financial aspects of setting up – there are usually fairly sizeable emotional and mental stresses that have to be overcome in order to make those first steps towards striking out on your own, or certainly – with no Employer support. The fact that you would be paying less National Insurance was just one of the benefits, albeit financial, that made taking the plunge worthwhile. We hope people still do, as there is nothing more rewarding as knowing that the amount of effort and work you put in correlates directly with the worth and reward and satisfaction that comes at the end of it.

Further reading..: